One of the most important pre-trip planning jobs is making sure you can access your money overseas. Without money that trip of a lifetime isn’t going to be much fun! On a short holiday you can carry the money that you’ll need with you but it’s not sensible to carry enough cash with you to cover a multi-month trip. You are going to need to access your money on the road.

Here are a few simple steps you can take to avoid finding yourself stranded with no cash in a foreign country.

Make sure your bank knows you are headed overseas.

Banks and credit card companies have security measures in place to alert them of potential fraudulent transactions. An unexpected overseas transaction will often result in your bank freezing your account. That’s definitely not ideal when you are overseas and suddenly have to work out how to get in contact with your bank, which might be shut because it’s the middle of the night back home.

This can easily be avoided by sharing your travel plans with your bank. Let them know what regions you expect to be in and for roughly how long. Even if you don’t know your exact itinerary you can give them a rough idea.

Work out what needs to be done in advance

Exchanging your money into another currency and arranging for international money transfers can take time. Technology means that larger, reliable companies like Travelex have these process down to a fine art but you don’t want to be caught out on the day you fly out with no access to cash.

Do you know what bills you have coming in while you are away? It’s a good idea to work this out and arrange for automatic payments while you are gone. If you do plan to transfer money from your home account to an overseas account, check with your bank that your account allows you to do this. Often this is a service you have to apply for.

If you plan on opening an overseas bank account, make sure you have copies of all the documents you might need. Or leave them with someone you trust back home that can fax them to you if needed.

Confirm that your cards can be used overseas.

Most cards can be used worldwide but not all. Some savings cards won’t work so you may need to look at converting any savings cards to debit cards. Most visa and mastercards will work no matter where you are in the world but some need to have this facility activated. Others allow purchases but not cash advances. Check with your bank or credit card company that your cards will work prior to leaving. That’s one suprise you can do with out when you first get off the plane on your trip of a lifetime! And be sure to do it well in advance in case you need to arrange for a new card.

Find a card with low overseas withdrawal fees

Overseas withdrawal fees can quickly add up. Your bank will most likely charge a fee for accessing your money overseas, as will the local bank that you are using. Even if your bank allows you to withdraw $2000 each day you might find that local ATMs limit you to much less than this. These fees can quickly add up to over $50/month.

You can take steps to reduce international withdrawal fees. Talk to your bank to find out if they offer any cards with lower fees on international withdrawals and start researching cards offered by other institutions. It is possible to find cards that charge no fees on international transactions. Travelex offers a multi-currency card that has no international transaction fees. Also check if your bank is partners with any international banks. Often international partners won’t charge a fee for using their ATMs.

Forward your mail to someone

It takes a very organised person to think through every possible bill or scenario that might occur while you are away. Forward your mail to a trusted relative or friend. That way if an unexpected bill comes in or you have bank notices that need urgent attending to they aren’t going to be sitting unopened for months.

Take backup cards

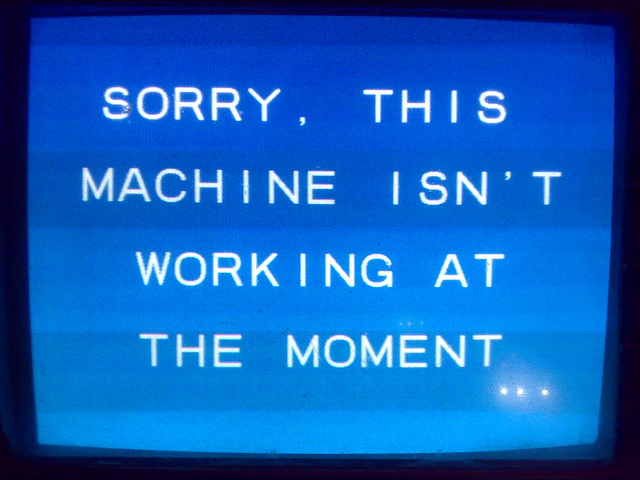

Cards can get lost, broken, stolen or even eaten by ATMs. Sometimes for no apparent reason the one ATM in the town you are staying in will stop recognizing your card, even though it had no problems the day before. Or maybe you’ve been spending over your budget lately and you discover at the worst possible time your card is maxed out.

Travelling with more than one card just makes sense. Your backup card should be from a different company and it should be a different type of card. If you already have a visa card apply for a mastercard. In Asia many places now prefer you to have a card with a ‘chip’ for EFTPOS transactions so try to make sure at least one of your cards has a ‘chip’.

Have some funds in reserve

It’s a good idea to have some emergency money hidden away somewhere. We’ve found this useful a number of times. Like during a 24 hour blackout where all the ATMs in town were out of action. Or when we’ve arrived in a town to discover the only ATM is out of order. And of course it’s particularly useful if your wallet is stolen. Make sure it’s in an easily exchangeable currency like US dollars.